Alpha Striker AI V4 introduction

● Product Name: Alpha Striker AI V4

● Development Team: https://alpha-striker.com/alpha-striker-v3-ea/

The developers claim that Alpha Striker AI V4 is capable of withstanding the challenges of pillar companies such as FTMO, My Funded Fx, The Funded Trader, and True Forex Funds, achieving a profit of 10-15% per month. Daily losses can be controlled within 3%, and TP (Take Profit) and SL (Stop Loss) are used in each trade. Additionally, the website page provides screenshots of profits from the mobile version of MT4 and some customer feedback.

Instructions for Use

■ Currency Pair: Any currency pair

■ Time Frame: M15 (Any time)

■ Minimum Lot Size: 0.01

■ Platform: MetaTrader 4

■ Minimum Deposit: $500

■ Leverage: 1:30 to 1:1000

■ Account Types: Hedge, Zero Spread, Cent, Micro, Standard, Premium, or ECN

Forward Testing

Alpha Striker AI V4 does not provide any verification for demo or live accounts; it only offers some screenshots of profitable trades from the mobile version of MT4 on the website.

BeliFX Perspective

Strategy Analysis

BELIFX PERSPECTIVE

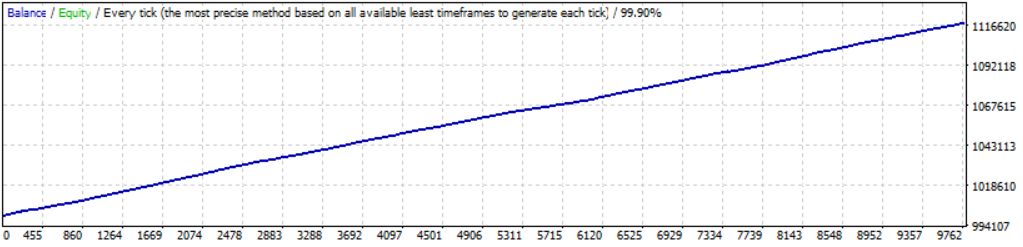

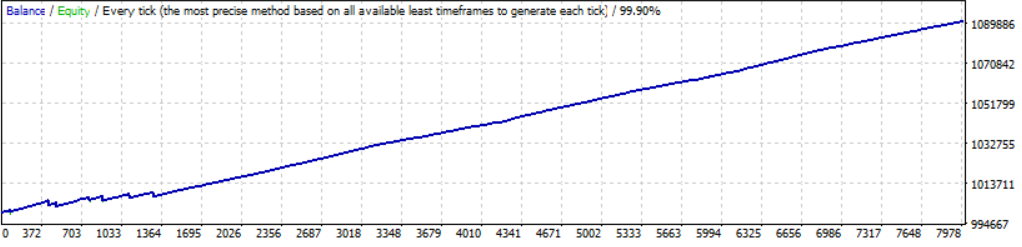

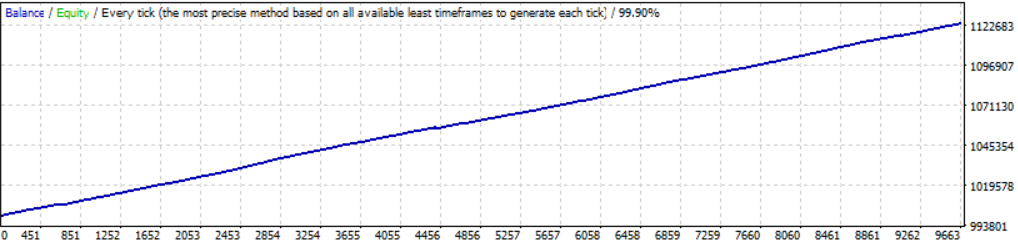

We randomly selected 3 trading instruments for backtesting, and the results showed a stable asset curve, seemingly perfect. However, when encountering such backtest curves, careful analysis is usually required. Alpha Striker AI V4 is a typical case; this EA has issues with falsification, and the backtest report is meaningless. No further interpretation of the backtest report is made.

The Alpha Striker AI V4 is a facelift of the popular EA WOLF FOREX SIGNAL EA in 2019. WOLF FOREX SIGNAL EA is an EA that falsifies data by reading K-line historical data. The Alpha Striker AI V4 continues the fraudulent behavior of WOLF FOREX SIGNAL EA by using the same methods for fraud. This EA back test curve is usually perfect, but in fact it is the principle of redrawing type indicators, showing only illusory foam.

BeliFX’s professional quantitative trading evaluation team, following us, we can show you the most authentic essence

Backtest Analysis

The purpose of backtesting is to determine the profit and risk expectations of algorithmic trading strategies in real-time trading. Only backtests with a fixed lot size can clearly reflect the relationship between maximum drawdown and capital volume. All backtests conducted by BeliFX use a fixed lot size.

Tick data source: Dukascopy Tested date: 2024.06.8

BeliFX Backtest

MT4 backtest report

| Symbol | AUDUSD (Australian Dollar vs US Dollar) | ||||

| Period | 15 Minutes (M15) 2014.01.02 00:00 – 2024.05.31 23:45 (2014.01.01 – 2024.06.03) | ||||

| Model | Every tick (the most precise method based on all available least timeframes) | ||||

| Bars in test | 259808 | Ticks modelled | 171107415 | Modelling quality | 99.90% |

| Mismatched charts errors | 0 | ||||

| Initial deposit | 1000000.00 | Spread | Variable | ||

| Total net profit | 117836.78 | Gross profit | 125568.85 | Gross loss | -7732.06 |

| Profit factor | 16.24 | Expected payoff | 12.09 | ||

| Absolute drawdown | 23.49 | Maximal drawdown | 481.37 (0.04%) | Relative drawdown | 0.04% (481.37) |

| Total trades | 9749 | Short positions (won %) | 3339 (93.41%) | Long positions (won %) | 6410 (94.10%) |

| Profit trades (% of total) | 9151 (93.87%) | Loss trades (% of total) | 598 (6.13%) | ||

| Largest | profit trade | 60.30 | loss trade | -129.27 | |

| Average | profit trade | 13.72 | loss trade | -12.93 | |

| Maximum | consecutive wins (profit in money) | 142 (1951.85) | consecutive losses (loss in money) | 7 (-333.46) | |

| Maximal | consecutive profit (count of wins) | 1951.85 (142) | consecutive loss (count of losses) | -402.27 (5) | |

| Average | consecutive wins | 22 | consecutive losses | 1 | |

High-level Analysis

Exception strategy, no further analysis required.

MT4 backtest report

| Symbol | EURUSD (Euro vs US Dollar) | ||||

| Period | 15 Minutes (M15) 2014.01.02 00:00 – 2024.05.31 23:45 (2014.01.01 – 2024.06.03) | ||||

| Model | Every tick (the most precise method based on all available least timeframes) | ||||

| Bars in test | 259817 | Ticks modelled | 250290365 | Modelling quality | 99.90% |

| Mismatched charts errors | 0 | ||||

| Initial deposit | 1000000.00 | Spread | Variable | ||

| Total net profit | 90843.34 | Gross profit | 109642.04 | Gross loss | -18798.70 |

| Profit factor | 5.83 | Expected payoff | 11.40 | ||

| Absolute drawdown | 753.93 | Maximal drawdown | 3068.10 (0.31%) | Relative drawdown | 0.31% (3068.10) |

| Total trades | 7968 | Short positions (won %) | 2915 (93.14%) | Long positions (won %) | 5053 (92.93%) |

| Profit trades (% of total) | 7411 (93.01%) | Loss trades (% of total) | 557 (6.99%) | ||

| Largest | profit trade | 162.87 | loss trade | -417.57 | |

| Average | profit trade | 14.79 | loss trade | -33.75 | |

| Maximum | consecutive wins (profit in money) | 147 (2092.41) | consecutive losses (loss in money) | 7 (-2041.47) | |

| Maximal | consecutive profit (count of wins) | 2092.41 (147) | consecutive loss (count of losses) | -2068.78 (6) | |

| Average | consecutive wins | 20 | consecutive losses | 1 | |

High-level Analysis

Exception strategy, no further analysis required.

MT4 backtest report

| Symbol | GBPUSD (Great Britan Pound vs US Dollar) | ||||

| Period | 15 Minutes (M15) 2014.01.02 00:00 – 2024.05.31 23:45 (2014.01.01 – 2024.06.03) | ||||

| Model | Every tick (the most precise method based on all available least timeframes) | ||||

| Bars in test | 259802 | Ticks modelled | 253081004 | Modelling quality | 99.90% |

| Mismatched charts errors | 0 | ||||

| Initial deposit | 1000000.00 | Spread | Variable | ||

| Total net profit | 123377.42 | Gross profit | 131223.47 | Gross loss | -7846.05 |

| Profit factor | 16.72 | Expected payoff | 12.79 | ||

| Absolute drawdown | 18.70 | Maximal drawdown | 1066.36 (0.10%) | Relative drawdown | 0.10% (1066.36) |

| Total trades | 9650 | Short positions (won %) | 3286 (94.37%) | Long positions (won %) | 6364 (94.56%) |

| Profit trades (% of total) | 9119 (94.50%) | Loss trades (% of total) | 531 (5.50%) | ||

| Largest | profit trade | 177.16 | loss trade | -210.58 | |

| Average | profit trade | 14.39 | loss trade | -14.78 | |

| Maximum | consecutive wins (profit in money) | 182 (2576.32) | consecutive losses (loss in money) | 7 (-99.02) | |

| Maximal | consecutive profit (count of wins) | 2576.32 (182) | consecutive loss (count of losses) | -908.14 (6) | |

| Average | consecutive wins | 23 | consecutive losses | 1 | |

High-level Analysis

Exception strategy, no further analysis required.